When it comes to your money, it's really all personal.

- Personal

- Mortgage

- Business

Your business is big, even when its small.

- Wealth / Trust

There's a big difference between saving money and building wealth.

- Resources

Learn here.

Meet Dan Hosman

From the Fields to the Boardroom: A Journey of Giving Back at Farmers & Merchants Bank

Dan Hosman's journey with Farmers & Merchants Bank has become one of giving back. A career farmer who cultivated a fruitful relationship with Farmers and Merchants Bank lenders, he’s now on the bank’s Board of Directors, applying his extensive business and agriculture experience to help others.

If you have not built a strong relationship with your bank, you’re missing out on one of the key elements to financial growth and well-being. From personalized guidance to community enrichment, a solid partnership with a bank and a bank associate can yield returns that not only benefit you and your family financially but also the broader community.

Read More about 5 Reasons Why Building a Relationship with Your Bank Matters

Fixed Income Markets Join Equities in Moving Higher

The equity markets continued their strong move higher year-to-date with another week of positive returns. This week fixed income joined in with its own positive return. Specifically, broad bond market indices advanced 1.1% for the week as interest rates move lower. The decline in bond yields is evidenced by the move in the 10-year Treasury from a yield of 4.27% to 4.10% over the one-week period. Inflation data that was in line with expectations contributed to the decline in yields, resulting in a positive return.

Read More about Wealth Management Weekly Insight March 6, 2024

Sentiment Abating?

Over this past week, yields modestly declined. The yield on the U.S. 10-year Treasury closed at 4.26%, which was below its yield of 4.33% a week ago.

Equity performance was mixed over this past week. U.S. equities declined 0.4%, pulled down by a 1.8% decline in Growth which fully offset the 1.3% advance in Value. Recall year-to-date Growth has been the driver of domestic equity performance as Value has continued its relative lag from 2023.

Read More about Wealth Management Weekly Insight February 21, 2024

Earnings Season Showing Strong Results

Equities were up marginally for the week despite falling after reaching record highs. Investors continue to adopt a “risk-on” mentality despite lofty price-to-earnings (P/E) valuations as corporate earnings appear to be generally strong. The S&P 500 finished up 0.1%, while the NASDAQ rose 0.6%. Small caps rose significantly during the week gaining 2.4%. Treasury yields backed up to three-month highs with bond indices falling 0.9%

Read More about Wealth Management Weekly Insight February 14, 2024

So Close, But No 5,000

Stocks continued their year-to-date advance but lost a bit of steam after the S&P 500 Index came remarkably close to hitting the 5,000 level for the first time. Year-to-date this market’s weighted benchmark is up 4.1% led by firms in the semiconductor, internet media, and streaming service providers. Longer-dated bonds underperformed with the Treasury getting ready to issue more debt after this week’s successful auctions which were at record levels.

Read More about Wealth Management Weekly Insight February 7, 2024

Powell Throws Cold Water on March Rate Cut

Equities finished the week down amid hawkish remarks from Fed Chair Powell. The S&P 500 suffered its worst single-day drop since last October, but gains earlier in the week helped limit the damage. The weekly decline was just 0.5%. The NASDAQ was down 2% as earnings reports from Big Tech sent shares down in select names. Bond yields rallied and returned 1.3% on the week.

Read More about Wealth Management Weekly Insight January 31, 2024

United States Economy Continues Its Resilience

After a negative performance last week, equities returned to the plus side in a meaningful way this week. The Russell 3000 Index of domestic stocks returned 2.1% for the period. The growth component of the index, the Russell 1000 Growth Index, was even more impressive with a return of 3.3%. Helping to propel stocks higher were last year’s two best-performing sectors: Information Technology and Communication Services. The leadership of these two sectors is also seen in the year-to-date differential between growth and value indices. The Russell 1000 Growth Index has returned 4.0% year-to-date, while the Russell 1000 Value Index is trailing with a return of -0.7%. Other market segments also moved higher for the week but at a more modest pace. Small cap stocks advanced 1.8% and developed markets outside the United States had an identical return, registering 1.8%.

Read More about Wealth Management Weekly Insight January 24, 2024

Equities Cool as the Fed to Go Slow on Rate Cuts

Equities finished the week down 0.9%, but there was weakness in some higher beta industries. Small caps lagged with a 2.9% drop and have started to give back a good chunk of their December outperformance. Small caps outpaced the S&P 500 by more than 10% over a two-month span into the last week of 2023. Since then, they have lagged by 6.5% in just over two weeks. Core bonds were down 0.3% on the week and extended the slow start to the year. The year-to-date return is down 1.2% with the 10-year Treasury higher by about 25 basis points.

Read More about Wealth Management Weekly Insight January 17, 2024

Market Overview

Over this past week, U.S. equities advanced 1.7%, while foreign equities rose 0.3%. Bonds declined 0.5% over the week, reflecting the near-term yield trend. According to FactSet, the yield for the U.S. 10-year Treasury retraced to 4.0% from 3.9% a week ago.

Read More about Wealth Management Weekly Insight January 10, 2024

Happy New Year!

Equities finished lower for the week due to a “risk-off” mentality in the markets, reversing the trend from the prior week. The S&P 500 finished down 1.6%, while the Nasdaq was down 3.4%. Small caps experienced a more significant sell-off, falling 4.5%. Treasury yields backed up during the week, off of their five-month lows, with bond indices falling 0.9%. The Magnificent 7, which has dominated stock market headlines for the better part of a year, underperformed the broader markets.

Read More about Wealth Management Weekly Insight January 3, 2024

Equities Inching Within Striking Distance of an All-Time High

Equities edged higher this week continuing the S&P 500’s longest run of weekly advances since 2017 and inching within striking distance of an all-time high. A turnaround is unlikely in the last two trading days of the year as the so-called Santa Claus rally has, since 1969, produced an average gain of 1.3% return over the last five days of the year and the first two of the new year. With a thin economic calendar this week, it is unlikely that either the 1.0% gain for the week or the 26.7% advance YTD will see any

meaningful retracement. While stock advances have been fueled by the Federal Reserve’s dovish pivot this month, the prospect of central bank cuts in 2024 has driven bonds to post a fourth straight week of gains, returning 4.7% since Thanksgiving. U.S. bond markets have returned 5.2% year-to-date, with corporate bonds leading the advance. This follows two years of negative bond market returns when interest rates climbed along with rising inflation, which drove bond prices lower.

Read More about Wealth Management Weekly Insight December 27, 2023

For investors, gift-giving has come early this year as the financial markets provided strong returns this week. Fixed-income investors saw a return of 1.0% for investment-grade bonds as the yield on the 10-year U.S. Treasury fell from 4.11% to 3.92%. This represented the first time since August that this bellwether of the bond market saw its yield below 4.0%. For equity investors, the gift was even more impressive as domestic indices generated returns in a range of 3.2% to 5.0%. While small-cap stocks, as measured by the Russell 2000 Index, have lagged their large-cap counterparts on a year-to-date basis they have come alive of late, returning 7.7% on a month-to-date basis. And in an indication of improved market breadth, returns for the week saw little difference between the growth and value segments of the market. The festive mood seen domestically did not carry over to foreign markets however as the MSCI All Country World ex USA returned a very modest 0.4% for the week.

Read More about Wealth Management Weekly Insight December 13, 2023

Mixed Market Performance

Broad equity markets exhibited mixed performance over the last week. Domestic equities rose 0.3%, as small caps advanced 2.7% while large caps rose 0.2%. Foreign equities increased 0.3% as foreign developed advanced 0.7% while emerging markets fell 0.4%.

Bonds rallied 1.0% over the last week given the plunge in interest rates. The yield on the 10-year U.S. Treasury closed yesterday at 4.1%, versus 4.3% a week ago and materially lower than 4.6% at the beginning of the fourth quarter.

Read More about Wealth Management Weekly Insight December 6, 2023

The VIX Index hits its lowest level since 2020

Equities were flat as volatility squeezed lower amid reduced holiday activity. The S&P 500 and NASDAQ Composite were close to unchanged on the week. Small caps fared better with gains of 0.5%. The VIX Index fell under 13 for the first time since the COVID outbreak. Core bonds gained 1.1% on the week as corporate bond spreads tightened alongside falling yields. The 10-year Treasury hit 4.25% this week, which is 75 basis points lower than its October high.

Read More about Wealth Management Weekly Insight November 29, 2023

Equities Surge Following CPI Report

Equities paused last week to consolidate large gains following the Federal Open Market Committee (FOMC) and Treasury funding announcement. Fears were elevated that the Consumer Price Index (CPI) would miss to the high side. Instead, it was a little better than expected and equities staged another huge run. The S&P 500 gained 2.8% on the week with the NASDAQ faring better at 3.4%.

Read More about Wealth Management Weekly Insight November 20, 2023

Employment data dominated the economic releases for the week as the unemployment rate ticked higher to 3.9%, the highest level since January 2022. Also, the increase in non-farm payrolls registered 150,000, below the anticipated increase of 180,000. Not only was the monthly increase lower than expected, but revisions were also made to the

results for the prior two months which reduced totals for those months by 101,000. Across private sector industries, only 52.0% reported increased levels of employment which is the lowest since April 2020. This month’s employment report was negatively impacted by the UAW strike in place against domestic auto manufacturers.

Read More about Wealth Management Weekly Insight November 8, 2023

Equities Rally as Event Risk Fades

Equities came into the week in a notable correction. The S&P 500 was 10% below its July peak and small caps were down almost 20%. Big events for the week included the Bank of Japan and their future path of policy, the Federal Reserve meeting, and the Treasury Quarterly Refunding announcement. As is usually the case, participants hedge ahead of the events. This paves the way for a potential rally absent a shock scenario.

Read More about Wealth Management Weekly Insight November 1, 2023

Equities Continue to Slide

Equity markets declined this past week, given the sustained rise in yields. U.S. equities declined 3.2% with U.S. small caps falling 4.5%, the worst performer for the week. Foreign equities declined 2.1%. Bonds also declined over the week.

Read More about Wealth Management Weekly Insight October 25, 2023

Equity Weakness Persists as Yields Hit Cycle Highs

Equities retreated this week as bond yields pushed to new cycle highs. The 10-year Treasury traded up to 4.98%, which sent average mortgage rates to 8.0%. Volatility has picked up due to action in the Middle East, but the theme of stronger-than-expected growth remains. This is causing back-end rates to move materially higher. The 10-year Treasury yield is up 36 basis points this week.

• The S&P 500 was down 1.4% on the week.

• The NASDAQ was down 2.5%.

• Core bonds were down 2.0%.

Read More about Wealth Management Weekly Insight October 18, 2023

This past week the broad bond market index advanced 1.0%, but the month-to-date result for October remains just slightly positive at 0.1%. This follows a week where bonds fell 1.2% as the yield on a U.S. Treasury 10-year bond traded in a range between 4.54% to 4.89%. Rates were pushed higher due to concerns about the impact on fiscal policy from a potential government shutdown along with growing levels of Treasury debt issuance. Rates moved lower after Monday’s bond market holiday close as investors sought out safe-haven bonds following a changing political dynamic in the Middle East. Broad equity market returns as measured by the Russell 3000 Index advanced 3.2% this week led by utilities. This followed a six-month period where this sector was the market’s biggest laggard. Technology was close behind at 4.2% as this segment continues to be this year’s leader, after being last year’s laggard. Year-to-date six of the 11 sectors that comprise the Russell 3000 remain negative reflecting the lack of breadth seen in the markets this year.

Read More about Wealth Management Weekly Insight October 11, 2023

Bond Yields Break to New Highs

Equities were down on the week as bond yields finally broke out to cycle highs. The S&P 500 was down 1.4% on the week. The NASDAQ was weaker with a drop of 2.5% as higher beta names underperformed. Core bonds were down 0.6%. Core bonds have fallen more than 4% from their year-to-date high and are now underwater on the year. The S&P 500 currently sits about 5% below its year-to-date high, while the NASDAQ is about 7.5% lower. Small caps are more than 10% lower.

Read More about Wealth Management Weekly Insight September 20, 2023

Summer Doldrums

Over the last week, fixed income rose to the top regarding cross-asset performance, rising 0.3%. U.S. equities declined 0.1%, as U.S. small caps fell 1.0% while large caps were flat. Outside the U.S., emerging markets declined 0.6% while foreign developed eked out a modest 0.1% increase.

Read More about Wealth Management Weekly Insight September 13, 2023

Equities Retreat as Bond Yields Approach Their Highs

Equities were down on the week amid mixed economic data and rising bond yields. The S&P 500 was down 1.1%, while foreign equities dropped 1.5%. Core bonds declined 1% as the 2-year Treasury revisited 5% and 10-year Treasury yields approached their highs. The 10-year Treasury finished the week at 4.28%, its third-highest daily closing level this year.

Read More about Wealth Management Weekly Insight September 6, 2023

Will The Most Anticipated Week of the Quarter Push Equities Higher or Lower?

Equities stabilized this week following much weaker global Purchasing Managers’ Index numbers. The weak economic data was treated as good news due to a sharp drop in Treasury yields. The NASDAQ led with gains of 1.8% while small caps were down slightly. Foreign equities were also down on the week, taking their cues from persistently weak Chinese economic data. Core bonds were up 0.6% despite the 10-year Treasury trading at its highest yield since 2007.

Read More about Wealth Management Weekly Insight August 23, 2023

Inflation data was at the forefront of this week’s economic data releases. The Consumer Price Index (CPI) readings came in at levels that were in line with, or better than, expectations. With its year-over-year reading of 3.2%, the CPI is just a little over one-third of the peak rate of 9.1% that occurred in June 2022. Producer prices came in a little stronger than anticipated, with a reading of 0.8% compared to an expected reading of 0.7%.

Read More about Wealth Management Weekly Insight August 16, 2023

Growing Global Macro Risks Push Equities Lower

Markets are off to a weak start to begin August. The S&P 500 is down 2.6% to begin the month, but this masks deeper drawdowns for many names. Apple fell 4.8% after earnings, its worst drop in nearly a year and helped ignite a larger sell-off in the technology sector. The NASDAQ is down 4.3% in August, while more beta-driven technology indices are down more than 6%. Semiconductors have fallen nearly 7% from their highs, while the AI bellwether, Super Micro Computer, fell 23% after its earnings release this week. Small caps, foreign equities, and core fixed income are also down.

Read More about Wealth Management Weekly Insight August 9, 2023

Over the last week, both bonds and equities exhibited negative returns. Bonds declined 1.2% while equities also retreated. Within the U.S., small caps declined 0.7% while large caps retraced 1.2%. Outside the U.S., emerging markets fell 1.1% while developed markets retreated 2.0%.

Read More about Wealth Management Weekly Insight August 2, 2023

Dow Jones Industrial Average Ties Longest Win Streak

The S&P 500 finished the week unchanged amid a sector rotation. The NASDAQ was down 1.6% while the Dow Jones Industrial Average was up 1.3%. The story of the week was the Dow Jones Industrial Average notching its 13th consecutive positive day. This was the longest streak since 1987, and should it be up today, will set the record for the longest winning streak in the 120+ year history of the Index.

Read More about Wealth Management Weekly Insight July 26, 2023

Equity Markets

Equity markets this past week continued to climb, up 1.9% for the MSCI USA Index which is a broad measure of domestic equity markets. In addition to the strong week, the index is up 3.9% for the month and 19.2% for the year. Gains from financial sector stocks helped the advance this week as second-quarter earnings for numerous sector members were better than expected. Weak sentiment for bank stocks remains despite stability in deposits, due to concerns about profitability, future regulatory pressure, and future credit losses. Overseas equity markets also advanced this week up 1.5%, and year-to-date 14.6% as reported by the MSCI EAFE Index. Markets in Japan were a key source of this gain after that nation’s central bank governor indicated a continuation of easy monetary policy.

Read More about Wealth Management Weekly Insight July 19, 2023

American consumers continue to reflect their economic confidence and a willingness to spend, as evidenced by recent strong results from the automobile industry. Earlier this week it was announced that in the first half of 2023 auto sales increased approximately 13%. The most current estimate of light vehicle sales for the month of June indicates an annualized sales level of 15.7 million units. This compares to a level of 13.3 million units in June of last year. What makes this strength even more impressive is the fact that the average price paid for a new vehicle has reached approximately $46,000 and the average monthly payment is now $733.00.

Read More about Wealth Management Weekly Insight July 12, 2023

NASDAQ Post Best First Half in 40 Years

Equities rallied back toward year-to-date highs to close out a strong first half performance. The S&P 500 was up 16.9% in the first two quarters of the year. The NASDAQ led the way with returns of 32.3%, its best first half since 1983. Small cap equities advanced 8.1%. Foreign development returned 12.2% while emerging markets lagged with a return of just 5.0%. Core fixed income posted gains of 2.1%.

Read More about Wealth Management Weekly Insight July 5, 2023

Did Equities Already Price in the Recession?

Markets took a pause this week to digest recent gains. The S&P 500 was up 0.3% as modest gains in the NASDAQ were offset by modest gains in small-cap equities. Foreign equities were a little softer with both developed and emerging markets down a little over 1%. Core bond returns were flat as implied interest rate volatility finally returned to levels seen prior to the Silicon Valley Bank collapse.

Read More about Wealth Management Weekly Insight June 28, 2023

Dog Days of Summer

We have formally entered the summer season, and one may expect markets to abate as vacation may now become the front-of-mind issue with investors. We’ve had a holiday-shortened week, but that did not restrain reports on the status of the economy.

Read More about Wealth Management Weekly Insight June 21, 2023

Sector Dispersion Solved as Small Caps Surge

The S&P 500 tacked on another 2.1% this week as small caps staged a vicious rally following the Friday jobs numbers.

Small caps were up 8.0% this week and notched their largest five-day advance in more than two years. Weakness in

small caps had been a common talking point as a reason to be skeptical of the rally but is no longer true. Core fixed

income was down 0.7% as yields moved higher.

Read More about Wealth Management Weekly Insight June 7, 2023

AI Frenzy Continues Amid Record Sector Dispersion

AI related stocks surged again this week. The big gains were Friday and Monday due to a keynote speech by NVIDIA’s CEO, Jensen Huang, at a technology

conference in Taipei over the weekend. Apparently even Uber drivers were asking passengers if they had watched the speech. AI mentions during earnings calls

have gone up from about 6,000 toward 25,000 this quarter.

NVIDIA gets most of the press, but the best performing stock has been Super Micro Computer, which is up more than 500% from its 52-week low. This is twice

NVIDIA’s advance of 250%. Semiconductor stocks were up about 11.5% on the week, which dragged the S&P 500 up 1.6%. The Dow Jones Industrial Average

was up just 0.4% and small caps were down 0.9%. Foreign developed equities lost 2%.

The NASDAQ finished May with a gain of 5.9% whereas the Dow Jones Industrial Average was down 3.2%. Going back to the creation of the NASDAQ in 1971,

there have only been eight other months where the spread was wider. Semiconductors were up more than 16% on the month. As AI related names surged, there

were seven S&P 500 sectors down more than 4% in the month of May. Somehow the S&P 500 was up 0.4% on the month when most sectors fell more than 4%.

Corporate earnings continue to be front-of-mind. Nvidia Corporation (NVDA) was the most recent example, beating expectations with revenue and earnings-per-share coming in better than consensus. NVDA was up +30% pre-market this morning, so much that it is on track to exceed $1 trillion in market capitalization. This would put NVDA in a unique club of companies whose market cap exceeds $1 trillion, joining Apple Inc. (AAPL), Microsoft Corporation (MSFT) and Amazon.com, Inc. (AMZN).

Stocks Rally as Jobs Remain Strong and Big Tech Gets Bigger

Equities moved higher as a stronger than expected jobs report helped alleviate recession fears. The S&P 500 advanced 1.2% on the week. The NASDAQ continued its relative strength by posting gains of 2.4%. Core bonds were down 0.5% as interest rates moved up on the week.

STUTTGART, AR – Farmers & Merchants Bank Senior Vice President, Chief Information Officer Rob Horan has been named to the Arkansas Money & Politics 2023 class of C-Suite Executives. Each year the publication recognizes noteworthy, top-level professionals across various industries for their dedication to excellence, leadership, and professional impact.

Read More about Horan Named to Arkansas Money & Politics C-Suite Executives

The Board of Directors of Farmers & Merchants Bank and The Bank of Fayetteville announces the recent promotion of two employees to key leadership roles. Kim Tucker will serve as Corporate Security and BSA Director and Lydia Frizzell will serve as the organization’s General Counsel.

Read More about Frizzell, Tucker to Lead Corporate Risk Management

STUTTGART, AR – Farmers and Merchants Bank is pleased to welcome Tracey Adams to the role of Commercial Loan Officer for the Mountain Home market. In her new role, Adams will build commercial relationships, work with strategic partners to support businesses in the North Central Arkansas region and manage a commercial lending portfolio.

Read More about Adams Joins Mtn Home Team As Commercial Loan Officer

This past week bond markets advanced 0.7%, led by treasury issues as declines across the yield curve boosted prices. This week’s advance

pushed the year-to-date return on the broader bond market to +3.46%. Contrary to this advance, stocks dropped this week by -2.0% to +5.4%, cutting the progress equity markets have made this year. Given recent earnings announcements it’s not surprising that financial and telecom companies led the downturn in which 10 of 11 sectors declined in value. The recession-proof consumer staples sector proved to be the only one to report an advance.

MOUNTAIN HOME, AR – Farmers and Merchants Bank is partnering with the Arkansas State University Mountain Home (ASUMH) Trailblazers on a new fundraising initiative for the athletics department.

For a limited time, the bank will have branded tumblers available at any of its Mountain Home area branches. In exchange for a $40 donation, supporters will receive a tumbler along with special discounts and free items at coffee shops around the Twin Lakes area.

Read More about Play the Field! Farmers and Merchants Bank Supports ASU Mountain Home Athletics

The Arkansas Bankers Association (ABA), the largest and oldest banking industry organization in the state, revealed a new slate of officers for 2024 as well as its new Board of Directors, who were installed at the ABA annual convention on April 5.

Brad Chambless, Chief Executive Officer and President of Farmers and Merchants Bank and The Bank of Fayetteville, has been named as the 2023-2024 Chairman-Elect. Chambless joined Farmers and Merchants Bank in 2006 where his roles there included Executive Vice President and member of the Board of Directors. He received his undergraduate degree from the University of Arkansas at Monticello and went on to earn a law degree from the University of Arkansas at Fayetteville, practicing law in Arkansas for 10 years before entering the banking industry.

Read More about Chambless Named Arkansas Bankers Association Chairman-Elect

Equities Hold up as Earnings Season Heats Up

Equities advanced on the week as better than expected economic data helped lift sentiment. Domestic indices continue to outpace foreign markets as the S&P 500 advanced 1.6% to notch its highest weekly close of the year. The NASDAQ continues to lead with a weekly advance of 1.9%. Bond yields moved higher on the week as core bonds lost 1.1%.

STUTTGART, AR –The Board of Directors of Farmers & Merchants Bank and The Bank of Fayetteville announces the promotion of two employees to key leadership roles. Blake Holzhauer will serve as Chief Credit Officer and Sammie Smith will serve as the organization’s Chief Analytics Officer.

Read More about Holzhauer, Smith Promoted to Key Leadership Roles

Economic data was at the forefront this week as current readings of inflation and employment were released. On the employment front both continuing jobless claims and initial claims were higher than anticipated. While labor markets continue to exhibit resilience these readings along with the recently announced decline in the JOLTS measure of job openings are creating a narrative of moderating strength in the labor market. This moderation could prospectively ease inflationary pressure in terms of decreasing upward pressure on wages. Also, while the unemployment rate did decline slightly versus the prior month’s reading the increase in payrolls was less than forecast.

Everything is in the Green for the First Quarter

Equity indices remained resilient with gains above 1% on the week. Small caps remain the laggard as macro-economic data begins to show early cracks. The S&P 500 is up about 7% in three weeks from its March low but remains a little more than 2% below the year-to-date (YTD) high set on the first day of February.

Equity Markets Shrug Off Extraordinary Bond Market Volatility

The S&P 500 was up 1.2% on the week as strength in large cap technology overcame weakness in smaller cyclical stocks. Cyclical stocks have been weak of late as global bank failures raise concern about the future growth trajectory. Investors appear to be viewing large cap technology as better insulated and have bid up prices in recent days.

Farmers & Merchants Bank is pleased to announce that two employees have been promoted to officer positions in the Western Market. Leslie Self now serves as Vice President, Credit Administration Officer and Kathleen Miller has been named to the role of Consumer Loan Officer.

Read More about Miller, Self Promoted to Officer in Western Market

Bank Term Lending Program

Investor focus this week has been on actions taken by regulatory authorities to assure safety of deposits at U.S. banks. On Sunday, regulators put into place a new Bank Term Lending Program that provides an additional safety net under all U.S. banks. The new borrowing program increased a bank’s borrowing capacity with the Federal Reserve in case a bank experiences liquidity needs because of depositor withdrawals. Under this program those banks that were closed last week opened again allowing depositors to withdraw funds regardless of amount. A ripple effect regarding the banking system has also been seen overseas as European authorities took actions to pair a stronger balance sheet bank with a weaker one to assure liquidity is in place to address depositor concerns.

Bond Market now Favors a 50 Basis Point Hike after Powell Opens the Door

The S&P 500 was volatile on the week but managed to gain 1.1% amid a fair amount of dispersion under the surface. The NASDAQ was up 1.8% while small caps were down 1%. Small caps have been weak of late following strong performance to begin the year. Foreign developed has also lost relative strength in recent weeks. Core fixed income was unchanged.

STUTTGART, AR – Farmers & Merchants Bank Mountain Home Market President Sally Gilbert has been named to the Arkansas Money & Politics 50 Over 50 class for 2023. Each year the publication recognizes professionals across Arkansas for commitment to their work and community. Gilbert has been recognized by the publication for the past two years for excellence in banking.

Read More about Gilbert Named to Arkansas Money & Politics 50 Over 50

The second estimate of fourth quarter GDP was front and center this week as a slew of economic data releases took place. The revised result was weaker than expected with a reading of 2.7% compared to an expectation of 2.9%. One of the factors contributing to the weaker result relative to the initial estimate was a downward revision of consumer spending during the period. The revision took the original estimate down from 2.1% for the quarter to 1.4%. Other positive contributors included inventory investment and government spending. Housing continued to be a detractor.

Equities Fall as Rising Yields Finally Take a Toll

The S&P 500 was down 3.8% on the week. Small caps fared slightly better and the NASDAQ slightly worse. As has been customary in recent market corrections, foreign developed markets exhibited a smaller downside move. The MSCI EAFE Index was down 0.9% on the week.

This past week saw the release of several economic reports geared toward the consumer. On Tuesday, the U.S. Bureau of Labor Statistics released its Consumer Price Index (CPI) for January. CPI rose 0.5%, in-line with expectations while above its 0.1% increase in December.

STUTTGART, AR – Farmers & Merchants Bank announced today that David Erstine of Fayetteville has joined the bank’s board of directors.

Erstine, SIOR, CCIM, is a Senior Vice President at CBRE, a global brokerage and commercial real estate management firm with local offices in Little Rock and Fayetteville. He brings more than 20 years of commercial real estate (CRE) market research and brokerage experience to his position on the bank’s board of directors.

Equities Whipsaw Around Conflicting Economic Data and Powell Comments

The S&P 500 was flat on the week but showed noticeable volatility intraday. A slight uptick in NASDAQ- related names was offset by slight weakness in value equities. This is a good sign that large January gains are holding. A modest rebound in the dollar sent emerging markets down 2.1%. Fixed income was down 1.4% on the week as a strong jobs report pushed yields higher.

STUTTGART, AR –The Board of Directors of Farmers & Merchants Bank and The Bank of Fayetteville announces the promotion of three employees to the role of Community President, where they will oversee retail and lending operations in growing markets across the state.

STUTTGART, AR – Farmers and Merchants Bank is pleased to welcome Nesha Guest to the role of Community Development Officer for the Jonesboro market. In her new role, Nesha will build customer relationships, work with strategic partners to support the Northeast Arkansas business and nonprofit community and oversee local charitable donations for the bank.

Read More about Guest Joins Jonesboro Team As Community Development Officer

U.S. equity markets as measured by the MSCI USA Index gained 0.6% this week finishing out January up 5.5%. This past month bond markets climbed 3.1% as interest rates continued to drop across the yield curve. This positive kickoff to 2023 comes as a relief after 2022 was the worst combined bond/stock return for several generations of investors.

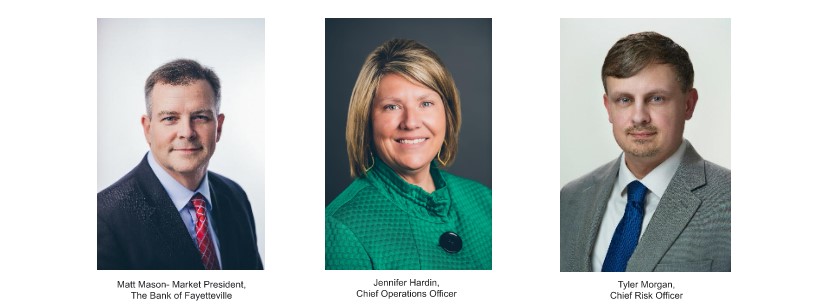

STUTTGART, AR – The Board of Directors of Farmers & Merchants Bank and The Bank of Fayetteville has welcomed Matt Mason back to The Bank of Fayetteville as the Northwest Arkansas Market President, where he will oversee retail and lending operations for eight bank locations. This announcement follows the promotion of longtime employees Jennifer Hardin, who will now serve as Chief Operations Officer, and Tyler Morgan, who will serve as Chief Risk Officer for the financial institution.

The NASDAQ Index Surges to Best Calendar Start Since 2000

Positive equity momentum continued this week as the S&P 500 gained 2.2%. Despite yields moving higher, the NASDAQ fared even better with a 3.3% advance, which is a little bit of a character change. Fixed income indices were down as yields moved slightly higher. The NASDAQ is up 8.9% this month, its fastest start to a year since 2000.

Equities continued to rise last week as virtually all major market indices moved higher. For domestic markets, small cap stocks led the way as the Russell 2000 Index returned 1.8%. Large-cap and mid-cap stocks also moved higher with weekly returns of 0.5% and 0.8%, respectively. Developed foreign markets matched U.S. small-cap stocks with a return of 1.8%.

Equities Begin the Year with Strong Gains

After a weak ending in 2022, equity markets are off to a good start in 2023. The S&P 500 is up 3.4% to begin the year while the NASDAQ and Russell 2000 are both up about 4.5%. Emerging markets are up an even stronger 6.3% as a lower U.S. dollar and falling yields are viewed in a favorable fashion. Core bonds begin the year with a gain of 2.3%.

Happy New Year!

Asset class returns have exhibited a welcome respite from that of 2022. Bonds have rallied 1.1% over the last week as interest rates have declined. U.S. and foreign equities have also exhibited positive returns of 2.1% and 2.0%, respectively. Value continues to outperform growth. While some may attribute this to the Santa Claus rally, investor sentiment may reflect the opinion that peak inflation is in the past and the Fed may need to pivot

STUTTGART, AR –The Board of Directors of Farmers & Merchants Bank and The Bank of Fayetteville announces the promotion of three long-time employees to the role of Executive Vice President. Kelly Houghton will serve as EVP, Chief Operating Officer, Greg Connell will serve as EVP, Chief Revenue Officer and Christy Malahy will serve as EVP, Chief Financial Officer.

As traders turn off their screens and head for the doors for a long weekend, market data was full of mixed signals. Mister Market was more Krampus than Santa Claus this week sending both bonds and stocks lower -1.2% and -2.9% respectively. This drawback follows strong gains for the quarter that still list bonds ahead +2.9% return and stocks up +8.6%.

Read More about Wealth Management Weekly Insight December 21, 2022

Inflation Drops – And Sets a Trap for the Bulls

Equities rallied on the week in anticipation of a better-than-expected Consumer Price Index (CPI) report and a dovish pivot from the Federal Reserve. The S&P 500 finished the week up 1.6% with core bonds flat. However, it was likely a more painful ride for investors than the return numbers would suggest.

Employment

Employment data was at the forefront of this week’s economic calendar. Despite concerns regarding an impending recession the employment picture continues to be resilient as the unemployment rate remained unchanged at 3.7%. Non-farm payrolls rose by 263,000, higher than the forecasted increase of 200,000. In addition to the above expected level of job growth, hourly earnings also surpassed expectations registering 5.1% for November compared to an anticipated increase of 4.6%.

Stocks Surge on Lower Inflation

Equities surged last Thursday when the Consumer Price Index (CPI) came in lower than expected. The S&P 500 jumped 5.55% on the day, the largest single day gain since March 2020. The NASDAQ’s 7.4% gain was the 14th largest in the 50-year series history. The 13 larger daily moves all occurred during recessions and only one (March 24, 2020) did not result in new lows before the bear market was over. Yields plunged lower on the week with core bonds returning more than 3%. It was the largest five-day gain for core fixed income since 1988.

Consumer Focused Data Week

With consumers representing almost 70% of the gross domestic product (GDP) in the U.S., this week’s economic news gave us a picture of how they are doing. A

reading on the job outlook showed mixed signals. While headline nonfarm payroll (Current Employment Statistics) increased by 261,000 in October (vs. 315,000 in

September), the household survey (Current Population Survey) painted a vastly different picture.

Read More about Wealth Management Weekly Insight - November 9, 2022

The Fed Fails to Pivot, Sparking Reversal in Equities

The S&P 500 ended the week down 1.8% thanks to a 3.6% drop in the last 90 minutes of trading as Federal Open Market Committee (FOMC) Chair Jerome Powell extinguished hopes of a bullish Fed pivot. It was the largest percentage drop for the S&P 500 in the last 90 minutes of a FOMC press conference since they began in 1994. The NASDAQ was hit the hardest this week with a drop of 4.1% while small caps had a milder retreat. Fixed income returns were roughly flat.

Read More about Wealth Management Weekly Insight November 2, 2022

Equities Stage Huge Reversal Off the Lows, But Will it Hold?

Volatility remains elevated as equity indices posted three consecutive 2% change days. The action started last week with a hotter than expected Consumer Price Index (CPI) report that led the S&P 500 to drop more than 2% to start trading on Thursday. It would finish the day up more than 2%. The index would then lose more than 2% on Friday only to gain 2.5% on Monday. For the week the S&P 500 finished up 3.3% with the energy sector coming to life and posting a gain of 5.2%. Emerging markets and foreign developed equities were positive on the week but lagged domestic indices. Core fixed income was down 1.4% as yields moved higher.

STUTTGART, AR – Farmers & Merchants Bank President of Agriculture Division and Dewitt Market President Kirk Vansandt has been named to the Arkansas Money & Politics 2022 class of Top 100 Professionals.

Read More about Vansandt Named to Arkansas Money & Politics Top 100 Professionals

Equities Retreat to New Lows Amid Rising Bond Yields

Equities traded lower this week with the S&P 500 trading at its lowest level of the year. The index finished down 1.9% on the week and is down 21.1% on the year. Emerging markets were down 6% on the week as global currency and bond market volatility spiked.

MOUNTAIN HOME, AR – The Baxter Healthy Foundation will benefit from a $5,000 sponsorship donation for the upcoming Buck-a-Roo Ball from Farmers and Merchants Bank.Members of the Farmers & Merchants team recently presented the check.

Farmers and Merchants Bank is proud to host a new Coffee Talk series at their main branch on Hickory Street in Mountain Home beginning Friday, September 2nd.

The free event series, which will provide an opportunity for Mountain Home neighbors to network, will feature community leaders and local projects. The first speaker will be Bomber Football Coach Steve Ary, who will forecast the upcoming season.

Read More about Farmers and Merchants Bank To Kickoff Coffee Talk Series with Coach Steve Ary

STUTTGART, AR – Farmers and Merchants Bank and The Bank of Fayetteville, a division of The Farmers and Merchants Bank, are pleased to announce the promotion of Marcus Seward to the role of Assistant Vice President, Loan & Bankruptcy Officer. In his new role Seward will maintain a diverse loan portfolio and develop commercial relationships in the Northwest Arkansas area.

Read More about Seward Promoted to Loan & Bankruptcy Officer

STUTTGART, AR – The Board of Directors of Farmers and Merchants Bank is pleased to announce the appointment of Randy Bearce to the position of Market President. In his new role, Bearce will oversee the retail and lending operations of the expanding Jonesboro market. Most recently, he served as a commercial lender.

Market President Named to 2022 Women in Business From Northwest Arkansas Business Journal

FAYETTEVILLE, AR – Northwest Arkansas Market President Jennifer Hardin has been recognized by the Northwest Arkansas Business Journal as one of the 2022 Women in Business. In her role, Hardin oversees the retail and lending operations of nine bank locations in Northwest Arkansas.

Read More about Hardin Receives Recognition in NWA Business Community

Read More about POSTPONED: Farmers & Merchants Bank to Host Ribbon Cutting

STUTTGART, AR – Farmers and Merchants Bank and The Bank of Fayetteville are pleased to announce the promotion of Pepper Morrison to the role of Assistant Vice President, Treasury Management Manager. In her new position, Morrison will oversee specialized products and banking strategies for business and nonprofit customers statewide.

Read More about Morrison Named AVP, Treasury Management Manager

Mountain Home Native to Lead Community Development Efforts

Farmers and Merchants Bank is pleased to welcome Katie Shay Schneider to the role of Community Development Officer for the Mountain Home market. In her new role, Katie will build local relationships, work with strategic partners to support the business community and improve quality of life in the North Central Arkansas region while overseeing charitable donations for the bank.

Read More about Baker Named VP, Market Operations Coordinator

Sally Gilbert, long-time Mountain Home resident and community banking leader, has joined Farmers & Merchants Bank as the new market president for Mountain Home and the surrounding communities. Gilbert will lead Farmers and Merchants Bank operations in the region with a focus on true community banking, ensuring the highest quality professional service and guiding the bank’s long-term investments and commitment to the Mountain Home community.

Read More about Sally Gilbert Appointed as Mountain Home Market President

Farmers & Merchants Bank and The Bank of Fayetteville would like to introduce you to our new MVP Centers. These Integrated Teller Machines are a new and improved way to do banking on the go! Follow this link to see a quick video on how our MVP works.

January 9, 2021 (Stuttgart, Arkansas)- The Board of Directors of Farmers and Merchants Bank and the Bank of Fayetteville announces the appointment of Brad Chambless as Chief Executive Officer and President as of January 1, 2021.

We work and live here, just like you. Supporting our communities is important. It's that simple.